Ethereum’s update is shaking up the crypto ecosystem, introducing a more virtuous way of working. But, the fallout remains unclear. If The Merge marks the end of mining on a major blockchain, it will probably not stop this activity.

There is a lot of uncertainty since “The Merge”, the update to Ethereum accomplished on September 15, 2022 by the platform’s developers. Does it mark the death of digital money miners? Not so fast. In the crypto community, people were hoping for the best from this groundbreaking update, while preparing for chaos, both technically and in the market. The trading of ethers (ETH), the native token of the aforementioned blockchain, was meticulously scrutinized, lest some speculators panic the counters.

“Everything went well in the end, both technically and on the price side [editor’s note: not so much, the price of Ethereum has dropped]. It was almost a non-event,” concedes Julien Gourlet, founder and CEO of Ilium, the Metz-based company that pioneered mining pools on Ethereum in France. In other words, Ilium does not mine directly from the crypto, but gathers a clientele composed of miners who combine their computing power.

With this technological paradigm shift led by Ethereum, the new proof-of-stake (PoS) mechanism that excludes miners, the market must surely restructure. We are seeing the beginnings of this. Miners have repositioned themselves to other proof-of-work (PoW) produced crypto-currencies. The most profitable of these are ether classic (ETC), ravencoin (RVN) or even flow (FLUX), to limit ourselves to a few examples. “These different blockchains have attracted a good portion of miners, but do not have the capacity to absorb the computing power of Ethereum. It is still too early to predict how all this will evolve,” says Julien Gourlet.

His company had obviously anticipated The Merge, first commercially, by offering its users a maximum of crypto-currencies that could continue to be mined. In other words, to allow their facilities, their graphics cards, to continue their activities while maintaining profitability. “Then, for the technical aspect, weeks of upstream preparation were necessary, with back and front-end developments to support users. And, cutting the mining pools at the time of The Merge,” explains the head of Ilium.

The inevitable migration of Ethereum into proof-of-stake

Falling into the mining pot in 2016 with Ethereum, blockchain consultant Mr. TK remembers: back then, with a small setup, even a simple computer, it was possible to create a few ETH per week or per month, depending on hardware configurations.

“We were still a long way from this mining farm takeover. Personally, I’ve never invested in GPU-ridden sheds like some people, but I’ve always mined at home. With an electric meter of a normal house, we avoid crazy installations with thousands of rigs [editor’s note: assemblies of one or more GPUs to mine permanently] next to each other,” recalls the most crypto of the Belgian Youtubers, a true enthusiast of “human scale” mining.

The switch to staking on Ethereum has not disturbed the activities of Mr. TK who, for a year already, had turned to other cryptos in PoW, assuming that they would grow in the future. The current movements prove him partly right, as these mined currencies have the wind in their sails among miners, investors and speculators.

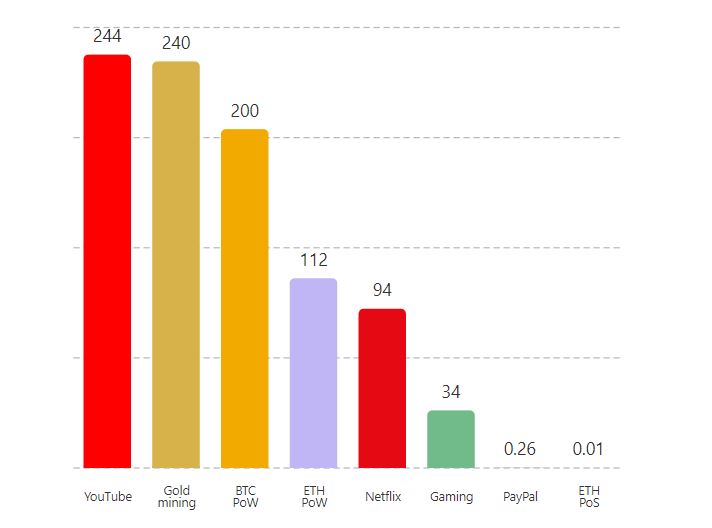

🌱 Due to the staggering amount of energy required to facilitate crypto transactions, many environmentalists have been pointing out the non-eco-friendly face of distributed ledger technologies. The merge that happened today significantly reduced the energy consumption of Ethereum https://t.co/p5ncTeiIrT

— European Crypto Initiative 🇪🇺 📍Berlin (@EuCInitiative) September 15, 2022

“Crypto mining kind of makes the dream of holding the proverbial money board at home a reality. You can make your own money, so to speak, without being a counterfeiter. It’s an exhilarating feeling, let’s face it. And, having discussed it around me, in a world of tokens, NFT, where everything is totally virtual, you have a very real, concrete, palpable material. This allows some people to understand that these are not Monopoly tickets,” enthuses the crypto creator.

Seen from the outside, for those who don’t share all these affinities with mining, it’s hard to see it as anything other than energy nonsense. “How can you boil the oceans with this nonsense? It’s terrible. I can’t believe you do this for a living,” the daughter of Ben Edgington, the product manager for Ethereum research and development company ConsenSys, took offense. Ben Edgington felt that his child was relaying “a very toxic environmental narrative,” asserting the usefulness of the crypto, without any nuance.

The ecological impact of crypto-currency mining, a complex issue

The essential ecological question that The Merge seems to solve is more complex than it seems.

“When mining is mentioned, the first criticism that comes up is usually about the electricity consumed. But, the people who cry energy scandal very often are not interested in the world of cryptos and can not be sensitive to their issues. […] It is important to put usage and its environmental impact into perspective. We all store poorly framed photos in the cloud, by the millions, on servers and in data centers all over the planet. No one is offended by this energy-consuming use,” says Mr. TK. However, this type of argument can be qualified: the energy sink that data centers represent, used for many activities on the Internet, is a known fact and regularly criticized.

To this, it should be added that not all crypto-currency miners necessarily fit the caricature that is often painted of them. “The perception of this business remains far too negative. Our professional clients use geothermal energy in Iceland, fatal energy in Quebec – that is to say, energy produced but not used – and help builders of hydroelectric power plants in Africa to overcome the problem of investment in these infrastructures, by objectifying and making the energy demand profitable,” emphasizes Julien Gourlet, suggesting that there is still a lack of understanding of the issues involved in mining. That said, it should be remembered that initiatives to reduce the crypto-currency sector’s dependence on fossil fuels are few and far between: less than 1% of the bitcoin hashrate uses only renewable energy. China and Kazakhstan, which represent a huge mining hub, do not use green energy.

Given the considerations against miners and the undeniable climate emergency, The Merge could serve as a strong argument in favor of an outright ban on mining. A possibility considered likely in the highest spheres of the EU, including the European Central Bank, which perceives in this computer activity a double risk, environmental and economic.

“In any case, crypto-currency mining will continue. There are still a huge number of PoW-based cryptos that will not change their mechanism, including bitcoin, which will a priori remain the reference asset at least for a while,” says Ilium’s CEO. He believes that the ecosystem could now check for flaws in the proof-of-stake. “There has been a lack of nuance so far claiming that PoS is great while PoW is an energy sink. It’s nonsense to say that PoS consumes nothing. It uses energy, but considerably less,” he continues.

The Merge, decentralization and security stress test

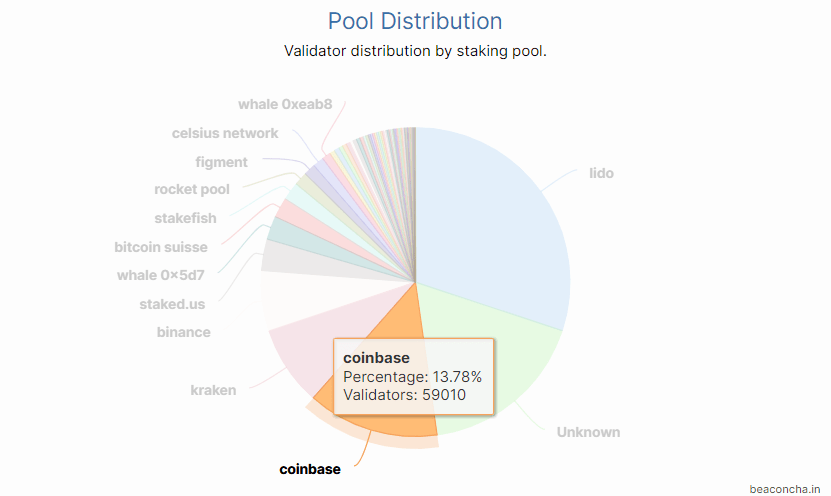

Despite significant efforts to ensure the sacrosanct decentralization of public blockchains, the problem of hoarding persists. Ethereum migration protesters assure that the centralization of the network is only changing hands from mining pools under the PoW to staking pools under the PoS.

“Until recently, we criticized the huge mining farms that were making the headlines on Ethereum. But we could still hope to compete with these players by buying a few machines. Now, it is, for example, Coinbase, Kraken and Binance that hold a huge part of the staked ETH and make the network run on their own”, observes Mr. TK.

A new situation that fuels new concerns. If tomorrow a government were to tighten regulations on crypto-assets to the extreme, no one knows yet how the new Ethereum blockchain would stand up to this pressure.

Another source of concern is security. The Merge creates a certain amount of confusion that cybercriminals want to take advantage of. Conversely, some players say that abandoning mining neutralizes or mitigates a range of attacks. “In addition, the cost of a PoS attack is exponentially higher due to slashing: the community might decide to forcibly exclude the attacker from the network and destroy his stashed ethers,” dixit CipherTrace, the US forensic blockchain analysis firm.

The young crypto industry has less experience with proof-of-stake. So far, no major flaws have occurred on major blockchains. It remains to be seen if this will always be the case with Ethereum.

“The Bitcoin network has had an accessibility rate of 99.8% since 2009, higher than Google’s rate over the past 13 years. That means it’s a system that is foolproof. As long as you have an Internet connection, Bitcoin is accessible. It’s an extraordinarily resilient and powerful system. Will we get that level with PoS? That remains to be seen,” says Julien Gourlet, CEO of Ilium.

The miners pillars then pariahs of the blockchain?

In the Mr. TK community, many people don’t want to hear about the mining that was synonymous with Ethereum until recently. Most have pulled the plug and are selling their hardware. Conversely, others in the community feel that a page is being turned, that Ethereum has worked tremendously well for seven years, but that the story of mining continues. “With some miners dropping out, the used graphics card market is teeming with low-cost hardware. Some people are getting equipped to take on new projects.”

There was no frustration among Ilium’s customers either. Entrepreneurial pragmatism prevailed. Many of Ilium’s users are professionals, hardware or hosting solution providers, who themselves have customers, both private and institutional.

“There is a lot of reflection, debates where we put the equations to get the best performance. But no bitterness. This migration was announced from the beginning, from the white paper in 2014, that was the vision. Then, Ethereum remains THE blockchain technology platform, even if others like Solana are doing well in terms of performance, none of them can compete with Ethereum in terms of ecosystem. None of them is able to unite as many developers, startups and projects around a blockchain. To remain the benchmark, Ethereum had to migrate for scalability reasons,” insists Julien Gourlet.

At Ilium, we already have an idea of what tomorrow will bring. Enjoying PSAN status since Tuesday, September 13, the young official digital asset provider will be offering ETH and other crypto-currency staking with a strong focus on miners.

“We’re looking at creating a hybrid mining and staking platform where users will be able to both produce crypto-currencies and automatically immobilize them, move them into staking. We’re going to combine the two competing dimensions in the physical world of blockchain. But, in fact, the two protocols complement each other, add up in terms of the gains that users can make,” says the Ilium supervisor.

For now, this historic event tends to demonstrate how blockchain and crypto have barely revealed their potential.